myccpay is an online payment platform that allows users to make secure and convenient payments for various services. It is widely used by businesses and individuals alike, offering a range of features to simplify the payment process.

The platform's key benefits include its ease of use, enhanced security measures, and compatibility with multiple devices. myccpay also provides detailed transaction records and supports multiple payment methods, making it a versatile solution for both personal and business transactions.

In today's digital age, seamless and secure payment options are essential. myccpay fulfills this need by providing a reliable and efficient platform for making payments online. Its user-friendly interface and robust security features make it an ideal choice for businesses and individuals seeking a convenient and secure payment solution.

myccpay

myccpay, an online payment platform, offers a comprehensive suite of features that cater to the diverse needs of businesses and individuals. Its key aspects encompass:

- Secure Transactions

- Seamless Integration

- Multiple Payment Options

- Detailed Transaction Records

- User-Friendly Interface

- Cross-Device Compatibility

- Fraud Prevention

- 24/7 Customer Support

- Competitive Fees

- PCI Compliance

These aspects combine to make myccpay a versatile and reliable payment solution. Its focus on security, convenience, and flexibility ensures that businesses and individuals can make payments with confidence and ease.

Secure Transactions

Secure transactions are the cornerstone of myccpay's service offerings. The platform employs robust security measures to safeguard sensitive data and prevent unauthorized access during payment processing. This commitment to security ensures that businesses and individuals can conduct transactions with confidence, knowing that their financial information is protected.

myccpay achieves secure transactions through a combination of advanced technologies and strict adherence to industry best practices. The platform utilizes SSL encryption, tokenization, and fraud detection systems to protect data during transmission and storage. Additionally, myccpay is PCI compliant, ensuring that it meets the highest standards for data security.

The importance of secure transactions cannot be overstated. Data breaches and unauthorized access to financial information can have severe consequences for businesses and individuals alike. myccpay's focus on security provides peace of mind, allowing users to make payments without the fear of compromising their sensitive data.

Seamless Integration

Seamless integration is a defining characteristic of myccpay, enabling businesses to effortlessly incorporate the payment platform into their existing systems and processes. This integration eliminates the need for complex manual data entry and reconciliation, reducing the risk of errors and streamlining operations.

The practical significance of seamless integration is evident in various scenarios. For instance, e-commerce businesses can integrate myccpay with their online stores, allowing customers to make secure payments directly from the checkout page. Similarly, brick-and-mortar stores can integrate myccpay with their point-of-sale (POS) systems, enabling cashiers to process payments quickly and efficiently.

myccpay's commitment to seamless integration extends beyond its own platform. The platform supports integration with popular accounting software, payment gateways, and other business applications. This flexibility allows businesses to tailor myccpay to their specific needs, creating a cohesive payment ecosystem that aligns with their existing workflows.

Multiple Payment Options

In today's diverse business landscape, customers expect a range of payment options to suit their preferences and needs. myccpay recognizes this need and provides businesses with the flexibility to accept multiple payment methods.

- Credit and Debit Cards: myccpay supports all major credit and debit card networks, ensuring that businesses can cater to the most commonly used payment methods.

- Electronic Checks: Businesses can accept electronic checks through myccpay, providing customers with an alternative to traditional paper checks.

- Online Banking: myccpay integrates with popular online banking platforms, allowing customers to make secure payments directly from their bank accounts.

- Mobile Payments: Businesses can accept payments via mobile wallets and QR codes, catering to the growing trend of mobile commerce.

Offering multiple payment options not only meets customer expectations but also expands the reach of businesses, allowing them to accept payments from a wider customer base. myccpay's comprehensive suite of payment options empowers businesses to conduct transactions seamlessly and increase their revenue potential.

Detailed Transaction Records

The ability to track and manage financial transactions efficiently is crucial for businesses of all sizes. myccpay recognizes this need and provides detailed transaction records that offer a comprehensive view of all payment activities.

- Real-Time Updates: myccpay provides real-time updates on all transactions, allowing businesses to monitor their cash flow and identify any discrepancies or fraudulent activities promptly.

- Historical Data: In addition to real-time updates, myccpay maintains historical transaction records, enabling businesses to track payment trends, analyze customer behavior, and make informed decisions.

- Export and Reporting: myccpay allows businesses to export transaction records in various formats, such as CSV and Excel, for further analysis and reporting. This feature simplifies the process of reconciling accounts and generating financial reports.

- Dispute Management: Detailed transaction records serve as valuable evidence in case of disputes or chargebacks. Businesses can easily retrieve and provide transaction details to payment processors or customers, facilitating the resolution process.

Overall, myccpay's detailed transaction records empower businesses with the necessary tools to manage their finances effectively, identify growth opportunities, and mitigate risks.

User-Friendly Interface

myccpay's user-friendly interface is a defining attribute that enhances the overall experience for both businesses and their customers. Its intuitive design and straightforward navigation make it easy for users to complete transactions seamlessly and efficiently.

- Simplified Navigation: myccpay's interface is meticulously designed to be user-intuitive, with clear menus, prominent buttons, and a logical flow of information. This simplified navigation enables users to find the features they need quickly and easily.

- Visual Clarity: myccpay's interface employs a clean and uncluttered design, with ample white space and well-organized elements. This visual clarity reduces distractions and allows users to focus on the task at hand, minimizing errors and frustrations.

- Responsive Design: myccpay's platform is fully responsive, adapting seamlessly to different screen sizes and devices. Whether accessed on a desktop, laptop, tablet, or smartphone, users can enjoy a consistent and optimized experience, regardless of their device preferences.

- Contextual Help: myccpay provides comprehensive contextual help and support throughout the platform. Users can access detailed explanations, tutorials, and FAQs directly within the interface, ensuring that they have the necessary guidance at their fingertips.

The user-friendly interface of myccpay empowers businesses to streamline their payment processes, reduce customer support inquiries, and enhance the overall satisfaction of their customers.

Cross-Device Compatibility

In the contemporary digital landscape, seamless experiences across multiple devices have become essential for businesses and consumers alike. myccpay recognizes the importance of cross-device compatibility, ensuring that its platform can be accessed and utilized effectively on a wide range of devices.

- Ubiquitous Accessibility: myccpay's cross-device compatibility empowers businesses to reach a broader customer base, as users can access the platform from their preferred devices, including desktops, laptops, tablets, and smartphones.

- Enhanced Convenience: Customers appreciate the flexibility to make payments, manage accounts, and track transactions from any device, at any time, without being restricted to a specific device or location.

- Streamlined Operations: For businesses, cross-device compatibility simplifies operations by allowing employees to process payments and manage financial activities from their preferred devices, increasing efficiency and productivity.

- Optimized User Experience: myccpay's responsive design ensures an optimal user experience across all devices, with a consistent interface and intuitive navigation, regardless of screen size or resolution.

Overall, the cross-device compatibility of myccpay aligns with the evolving needs of businesses and customers, providing a convenient, accessible, and efficient payment solution in today's multi-device environment.

Fraud Prevention

Fraud prevention is a critical aspect of online payment processing, and myccpay takes a proactive approach to safeguarding its users from fraudulent activities.

- Real-Time Monitoring: myccpay employs advanced monitoring systems that analyze every transaction in real-time, identifying suspicious patterns and flagging potentially fraudulent activities.

- Address Verification System (AVS): myccpay integrates with AVS to verify the cardholder's billing address, reducing the risk of card-not-present fraud.

- Card Verification Value (CVV): myccpay requires customers to provide the CVV code, a unique security code printed on the back of the card, to further authenticate genuine cardholders.

By implementing these robust fraud prevention measures, myccpay minimizes the risk of unauthorized transactions and protects its users from financial losses. This commitment to security ensures that businesses and individuals can transact with confidence, knowing that their sensitive information is safeguarded.

24/7 Customer Support

In the fast-paced digital age, businesses and individuals rely heavily on payment platforms that provide seamless and reliable services. myccpay recognizes the importance of uninterrupted access to support, offering 24/7 customer support as an integral component of its platform.

This dedicated support service ensures that users can receive assistance and resolve any issues they may encounter at any time of the day or night. Whether it's a technical difficulty, a payment query, or a security concern, myccpay's customer support team is readily available to provide prompt and effective solutions.

The practical significance of 24/7 customer support extends beyond immediate problem-solving. It instills confidence in users, knowing that they can seek assistance whenever needed. This sense of security is particularly crucial for businesses that rely on myccpay for their payment processing, as any downtime or unresolved issues can lead to lost revenue and reputational damage.

Competitive Fees

myccpay is committed to providing businesses and individuals with a cost-effective payment solution. One of the key aspects that sets myccpay apart is its competitive fees, which offer a range of benefits:

- Lower Transaction Costs: myccpay's competitive fees directly impact the cost of processing transactions, allowing businesses to save money on each payment. These savings can accumulate significantly, especially for businesses with high transaction volumes.

- Increased Profitability: By reducing transaction costs, myccpay enables businesses to increase their profitability. The savings from competitive fees can be reinvested back into the business, used to expand operations, or passed on to customers in the form of lower prices.

- Enhanced Competitiveness: In today's competitive market, businesses need to find ways to differentiate themselves and attract customers. Offering lower transaction fees can be a compelling advantage, making myccpay an attractive payment solution for both businesses and their customers.

- Improved Cash Flow: Competitive fees can improve a business's cash flow by reducing the amount of money that is tied up in transaction costs. This improved cash flow can be used to fund growth initiatives, cover unexpected expenses, or increase working capital.

Overall, myccpay's competitive fees provide significant advantages for businesses, helping them save money, increase profitability, and improve their overall financial health.

PCI Compliance

PCI compliance is essential for any organization that accepts, transmits, or stores credit card information. myccpay takes PCI compliance seriously and has implemented a number of measures to protect customer data.

- Data Encryption: myccpay uses strong encryption to protect customer data both at rest and in transit. This ensures that even if data is intercepted, it cannot be decrypted without the encryption key.

- Regular Security Audits: myccpay undergoes regular security audits to identify and address any potential vulnerabilities. These audits are performed by independent third-party security firms.

- Employee Training: myccpay employees are trained on PCI compliance best practices. This training helps to ensure that employees are aware of the importance of protecting customer data.

- Restricted Access: Access to customer data is restricted to authorized employees only. This helps to reduce the risk of data breaches.

By implementing these measures, myccpay helps to protect customer data from unauthorized access and theft. PCI compliance is an essential part of myccpay's commitment to providing a safe and secure payment processing service.

myccpay FAQs

This section addresses frequently asked questions about myccpay, aiming to provide clear and concise answers. These FAQs cover common concerns and misconceptions, offering valuable insights into the platform's features, benefits, and usage.

Question 1: Is myccpay secure?

myccpay employs robust security measures to protect user data. It utilizes encryption, adheres to PCI compliance standards, and undergoes regular audits. These measures safeguard sensitive information during transmission and storage.

Question 2: What payment methods does myccpay support?

myccpay supports a range of payment methods for convenience and flexibility. Users can make payments using credit cards, debit cards, electronic checks, online banking, and mobile wallets.

Question 3: Are there any fees associated with using myccpay?

myccpay offers competitive fees for its services. The platform's pricing structure is transparent, and businesses can choose the plan that best suits their needs and transaction volume.

Question 4: How do I integrate myccpay with my website or business?

myccpay offers seamless integration with websites and various business systems. Its user-friendly interface and comprehensive documentation make the integration process simple and straightforward.

Question 5: Does myccpay provide customer support?

myccpay's dedicated customer support team is available 24/7 to assist users with any queries or issues. They provide prompt and efficient support to ensure a smooth payment processing experience.

Question 6: What are the benefits of using myccpay?

myccpay offers numerous benefits, including secure transactions, multiple payment options, competitive fees, user-friendly interface, seamless integration, and reliable customer support. These features empower businesses to streamline their payment processes and enhance their overall financial operations.

In summary, myccpay's commitment to security, flexibility, cost-effectiveness, and customer support makes it a trusted and efficient payment solution for businesses of all sizes.

Transition to the next section: Exploring the Key Features of myccpay

myccpay Tips

myccpay offers a comprehensive suite of features to enhance the payment processing experience for businesses. Here are some valuable tips to optimize the use of myccpay's services:

Tip 1: Leverage Multiple Payment Options

myccpay supports a wide range of payment methods, including credit cards, debit cards, electronic checks, and mobile wallets. By offering multiple payment options, businesses can cater to the diverse preferences of their customers, increasing the likelihood of successful transactions.

Tip 2: Ensure PCI Compliance

PCI compliance is essential for protecting sensitive customer data. myccpay adheres to strict PCI standards and employs robust security measures, including encryption and regular audits. Businesses can trust myccpay to safeguard their customers' financial information.

Tip 3: Utilize Real-Time Transaction Monitoring

myccpay's real-time transaction monitoring system enables businesses to stay vigilant against fraudulent activities. By identifying suspicious patterns and flagging potentially fraudulent transactions, businesses can minimize financial losses and protect their reputation.

Tip 4: Take Advantage of Detailed Transaction Records

myccpay provides detailed transaction records that offer a comprehensive view of all payment activities. Businesses can use these records to track cash flow, identify trends, and make informed decisions to optimize their financial operations.

Tip 5: Benefit from Competitive Fees

myccpay's competitive fees can help businesses save money on each transaction. These savings can accumulate over time, particularly for businesses with high transaction volumes, leading to increased profitability and improved cash flow.

Tip 6: Leverage 24/7 Customer Support

myccpay's dedicated customer support team is available 24/7 to assist businesses with any queries or issues. This reliable support ensures that businesses can resolve problems promptly, minimize downtime, and maintain smooth payment processing operations.

By following these tips, businesses can harness the full potential of myccpay's services, enhance their payment processing efficiency, and provide a seamless experience for their customers.

myccpay

myccpay stands out as a reliable and feature-rich payment platform, empowering businesses with secure, flexible, and cost-effective payment processing. Its commitment to security, customer support, and innovation positions it as a trusted partner for businesses seeking to optimize their financial operations.

In today's rapidly evolving digital landscape, businesses need a payment solution that can keep pace with their changing needs. myccpay's ongoing development and commitment to providing cutting-edge services ensures that it remains at the forefront of payment processing technology.

Kelsey Riggs: Age, Career, And Net Worth Revealed!

Uncover The Truth: Kelsey Riggs' Marital Status Revealed

Unveil Jon Krakauer's Net Worth: Discoveries And Insights

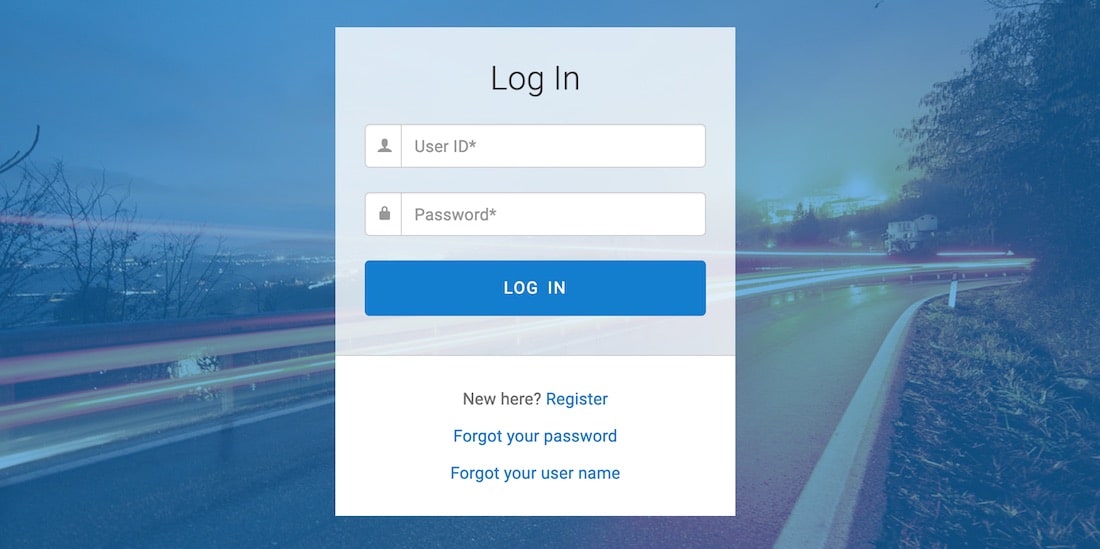

MyCCPay Login Online Official

MyCCPay Login Guide Total Visa Card Payment

ncG1vNJzZmickaCDb63MrGpnnJmctrWty6ianpmeqL2ir8SsZZynnWS6uq%2FCqZiyZpipuq0%3D