Dale Sigler's net worth is the estimation of his financial assets, liabilities, and ownership interests. It is calculated by subtracting his liabilities from his total assets.

Net worth is a valuable financial indicator for individuals and businesses, providing insights into their financial health and stability. It is commonly used by banks and other lenders to assess creditworthiness when making lending decisions. In the case of public figures like Dale Sigler, net worth also serves as a benchmark of their wealth and financial success, often attracting public interest and scrutiny.

The net worth of Dale Sigler, a prominent figure in the business and entertainment industry, has been the subject of much speculation and estimation. However, determining his exact net worth remains a subject of private knowledge, as such financial information is not publicly disclosed. If you want to learn more about Dale Sigler, his career, investments, and estimated net worth, feel free to refer to credible sources.

Dale Sigler Net Worth

Dale Sigler's net worth, a measure of his financial standing, encompasses various aspects that contribute to his overall wealth. Understanding these key aspects provides insights into his financial success and stability.

- Assets: Properties, investments, and other valuable possessions.

- Liabilities: Debts, loans, and financial obligations.

- Income: Earnings from various sources, including salary, investments, and business ventures.

- Investments: Allocation of funds into stocks, bonds, real estate, or other financial instruments.

- Business ventures: Ownership and involvement in profitable companies or projects.

- Net worth growth: Increase in the value of assets relative to liabilities over time.

- Wealth management: Strategies employed to preserve and grow net worth.

- Financial planning: Long-term strategies to achieve financial goals and secure future wealth.

- Estate planning: Arrangements for the distribution of assets after death.

These aspects are interconnected and influence Dale Sigler's net worth. His income and investments contribute to the growth of his assets, while liabilities and financial planning impact his overall financial standing. Understanding these key aspects provides a comprehensive view of his financial well-being and the factors that contribute to his wealth.

Assets

Assets form a crucial component of Dale Sigler's net worth, representing his ownership of valuable properties, investments, and possessions. The value of these assets contributes directly to his overall financial standing and wealth.

Real estate properties, such as houses, apartments, and land, are significant assets that can appreciate in value over time, providing a stable foundation for net worth growth. Dale Sigler's investment portfolio, comprising stocks, bonds, and other financial instruments, further diversifies his assets and generates passive income streams.

Other valuable possessions, including artwork, jewelry, and collectibles, may also contribute to his net worth, depending on their rarity and market value. These assets not only hold intrinsic value but can also serve as a hedge against inflation and economic downturns.

Understanding the connection between assets and Dale Sigler's net worth is essential for assessing his financial strength and stability. By carefully managing and growing his asset portfolio, he can increase his net worth over time, secure his financial future, and achieve his long-term financial goals.

Liabilities

Liabilities represent the debts, loans, and financial obligations that Dale Sigler owes to individuals, institutions, or organizations. They are crucial in determining his net worth and provide insights into his financial leverage and risk profile.

- Outstanding Loans: Dale Sigler may have acquired loans for various purposes, such as business ventures, real estate investments, or personal expenses. These loans carry an obligation to repay the principal amount along with interest, affecting his net worth.

- Mortgages: If Dale Sigler has purchased property using a mortgage, the outstanding balance on the mortgage is considered a liability. The mortgage payments include principal, interest, and other fees, impacting his cash flow and net worth.

- Business Debts: Dale Sigler's business ventures may involve liabilities such as accounts payable, outstanding invoices, and unpaid taxes. Managing these liabilities effectively is crucial for the financial health of his businesses.

- Personal Debts: Dale Sigler may have personal debts such as credit card balances, personal loans, or unpaid bills. These debts accumulate interest and can strain his cash flow, ultimately affecting his net worth.

Understanding the types and implications of Dale Sigler's liabilities is essential for assessing his financial standing. By effectively managing his liabilities, Dale Sigler can minimize their impact on his net worth, maintain a healthy credit profile, and position himself for long-term financial success.

Income

Income plays a pivotal role in determining Dale Sigler's net worth, representing the inflow of funds that contribute to the growth of his assets. Understanding the various sources of his income provides insights into the dynamics of his wealth accumulation and financial stability.

- Salary and Wages: Dale Sigler's primary income source may come from his salary and wages earned through his employment or professional activities. A stable and growing salary contributes significantly to his net worth.

- Investment Income: Dale Sigler's investments in stocks, bonds, and other financial instruments generate passive income streams. Dividends, interest payments, and capital gains from these investments contribute to his overall income and net worth growth.

- Business Ventures: Dale Sigler's involvement in business ventures, such as owning businesses or investing in startups, can generate substantial income. Profits from these ventures directly impact his net worth, especially if the businesses experience growth and profitability.

- Other Income: Dale Sigler may have additional income streams from royalties, endorsements, or other sources. These forms of income, while potentially smaller, can still contribute to his overall financial picture.

The combination of these income sources provides Dale Sigler with the financial means to cover his expenses, invest for the future, and grow his net worth. By diversifying his income streams and maximizing his earning potential, he can enhance his financial resilience and achieve long-term wealth accumulation goals.

Investments

Investments play a crucial role in shaping Dale Sigler's net worth, as they represent the allocation of his funds into various financial instruments with the potential to generate income and appreciate in value over time.

- Diversification and Risk Management: By investing in a mix of stocks, bonds, and real estate, Dale Sigler diversifies his portfolio, reducing overall risk and increasing the stability of his net worth. This balanced approach helps mitigate the impact of market fluctuations and economic downturns.

- Income Generation: Investments in dividend-paying stocks and bonds provide Dale Sigler with a steady stream of passive income, which can supplement his salary and contribute to his overall wealth accumulation. This income can be reinvested or used to cover expenses, enhancing his financial flexibility.

- Long-Term Growth: Stocks and real estate have the potential for long-term capital appreciation, allowing Dale Sigler to grow his net worth significantly over time. By investing in companies with strong growth prospects and properties in desirable locations, he can benefit from market trends and increase the value of his investment portfolio.

- Tax Benefits: Certain investments, such as municipal bonds and retirement accounts, offer tax advantages that can reduce Dale Sigler's tax liability and increase his net worth. Utilizing these tax-efficient strategies allows him to maximize his investment returns and preserve his wealth.

In summary, Dale Sigler's investments serve multiple purposes, including diversification for risk management, generation of passive income, long-term capital appreciation, and tax optimization. By carefully managing his investment portfolio and making strategic allocation decisions, he can enhance his net worth and achieve his financial goals.

Business ventures

The ownership and involvement in profitable companies or projects can significantly impact Dale Sigler's net worth, shaping his financial standing and overall wealth accumulation.

- Equity Ownership: As an owner or shareholder in successful businesses, Dale Sigler benefits from the profits and capital appreciation of those ventures. Dividends and stock value growth directly contribute to his net worth, potentially generating substantial wealth over time.

- Operational Involvement: Actively participating in the operations and management of profitable businesses allows Dale Sigler to influence their performance and decision-making. By driving growth, increasing efficiency, and maximizing profitability, he can positively impact the value of his business ventures and ultimately his net worth.

- Strategic Investments: Dale Sigler may invest in promising startups or emerging companies with high growth potential. These strategic investments can generate significant returns if the businesses succeed, leading to an increase in his net worth.

- Risk and Reward: Business ventures involve inherent risks, and the success or failure of these ventures can impact Dale Sigler's net worth. Careful assessment and management of risks are crucial to preserve and grow his wealth.

In conclusion, Dale Sigler's involvement in profitable business ventures plays a significant role in shaping his net worth. By leveraging his expertise, making strategic investments, and actively managing his business interests, he can maximize the potential for wealth accumulation and long-term financial success.

Net worth growth

Net worth growth is a crucial aspect of Dale Sigler's overall financial well-being and wealth accumulation. It reflects the increase in the value of his assets relative to his liabilities over time. This growth is a key driver of Dale Sigler's net worth and is essential for building and maintaining long-term financial security.

Several factors contribute to net worth growth, including the appreciation of assets, such as real estate and investments, as well as the reduction of liabilities, such as debt. Dale Sigler's ability to manage his assets and liabilities effectively, make sound investment decisions, and pursue opportunities that generate positive returns can significantly impact his net worth growth.

For example, if Dale Sigler invests in a property that increases in value over time, the equity he holds in that property will increase, contributing to his net worth growth. Similarly, if he pays down his mortgage, he reduces his liabilities, which also leads to net worth growth.

Understanding the connection between net worth growth and Dale Sigler's net worth is essential for making informed financial decisions. By focusing on strategies that promote asset growth and liability reduction, Dale Sigler can maximize his net worth and achieve his long-term financial goals.

Wealth management

Wealth management encompasses a range of strategies employed to preserve and grow an individual's net worth. In the case of Dale Sigler, effective wealth management is crucial for maintaining and enhancing his financial well-being.

Wealth management strategies involve managing assets and liabilities, making sound investment decisions, and planning for the future. By diversifying his portfolio, managing risk, and maximizing returns, Dale Sigler can protect his wealth from market fluctuations and economic downturns while also creating opportunities for growth.

For example, Dale Sigler may allocate his assets across different asset classes, such as stocks, bonds, and real estate, to reduce risk and enhance returns. He may also invest in growth-oriented assets, such as promising startups or emerging markets, to potentially increase the value of his portfolio over time.

Effective wealth management requires continuous monitoring, rebalancing, and adjustment to changing circumstances. Dale Sigler's wealth managers work closely with him to ensure that his financial strategies remain aligned with his risk tolerance, investment goals, and long-term financial objectives.

By employing sound wealth management strategies, Dale Sigler can preserve and grow his net worth, ensuring his financial security and the well-being of his family for years to come.

Financial planning

Financial planning plays a vital role in shaping Dale Sigler's net worth and ensuring his long-term financial well-being. It involves setting financial goals, creating a roadmap to achieve those goals, and implementing strategies to manage risk and grow wealth over time.

- Goal Setting: Financial planning begins with defining clear and specific financial goals. Dale Sigler may set goals related to retirement, education funding, or wealth accumulation. Well-defined goals provide direction and motivation for his financial decisions.

- Investment Planning: A crucial aspect of financial planning is investment planning. Dale Sigler's investment strategy should align with his risk tolerance, time horizon, and financial goals. Diversification, asset allocation, and regular portfolio reviews are essential for managing investment risk and maximizing returns.

- Retirement Planning: Retirement planning is a critical component of Dale Sigler's financial plan. It involves estimating retirement expenses, determining appropriate savings targets, and selecting retirement investment vehicles. Effective retirement planning ensures a financially secure future.

- Tax Planning: Tax planning is an integral part of financial planning. Dale Sigler's financial advisor can help him minimize his tax liability through strategies such as retirement account contributions, tax-advantaged investments, and charitable giving.

By implementing a comprehensive financial plan, Dale Sigler can increase his net worth, achieve his financial goals, and secure his financial future. Regular monitoring and adjustments to the plan are necessary to account for changing circumstances and ensure alignment with his evolving financial needs and objectives.

Estate planning

Estate planning plays a crucial role in managing and preserving Dale Sigler's net worth beyond his lifetime. It involves making arrangements for the distribution of his assets after death, ensuring that his wealth is transferred according to his wishes and minimizes the impact of estate taxes and legal challenges.

- Wills and Trusts: Wills and trusts are legal documents that form the foundation of estate planning. A will outlines the distribution of assets to beneficiaries and appoints an executor to manage the estate. Trusts allow for more complex asset management, providing flexibility and control over the distribution of assets over time.

- Estate Taxes: Estate taxes can significantly reduce the net worth passed on to beneficiaries. Estate planning strategies, such as establishing trusts and utilizing tax exemptions, can help minimize the impact of these taxes and preserve wealth.

- Probate: Probate is the legal process of administering an estate after death. Estate planning can simplify and expedite the probate process, reducing costs and delays in the distribution of assets.

- Legacy Planning: Estate planning goes beyond the distribution of assets. It also involves ensuring that Dale Sigler's values, philanthropic intentions, and legacy are honored after his death. Through estate planning, he can direct charitable contributions and establish foundations that support causes close to his heart.

Estate planning is an essential aspect of wealth management and preservation for Dale Sigler. By making thoughtful arrangements, he can protect his net worth, ensure the orderly distribution of his assets, and leave a lasting legacy that reflects his values and goals.

FAQs about Dale Sigler's Net Worth

Dale Sigler's net worth has been a topic of public interest and speculation. To address some common questions and misconceptions, here are answers to frequently asked questions about his financial standing:

Question 1: What is Dale Sigler's net worth?

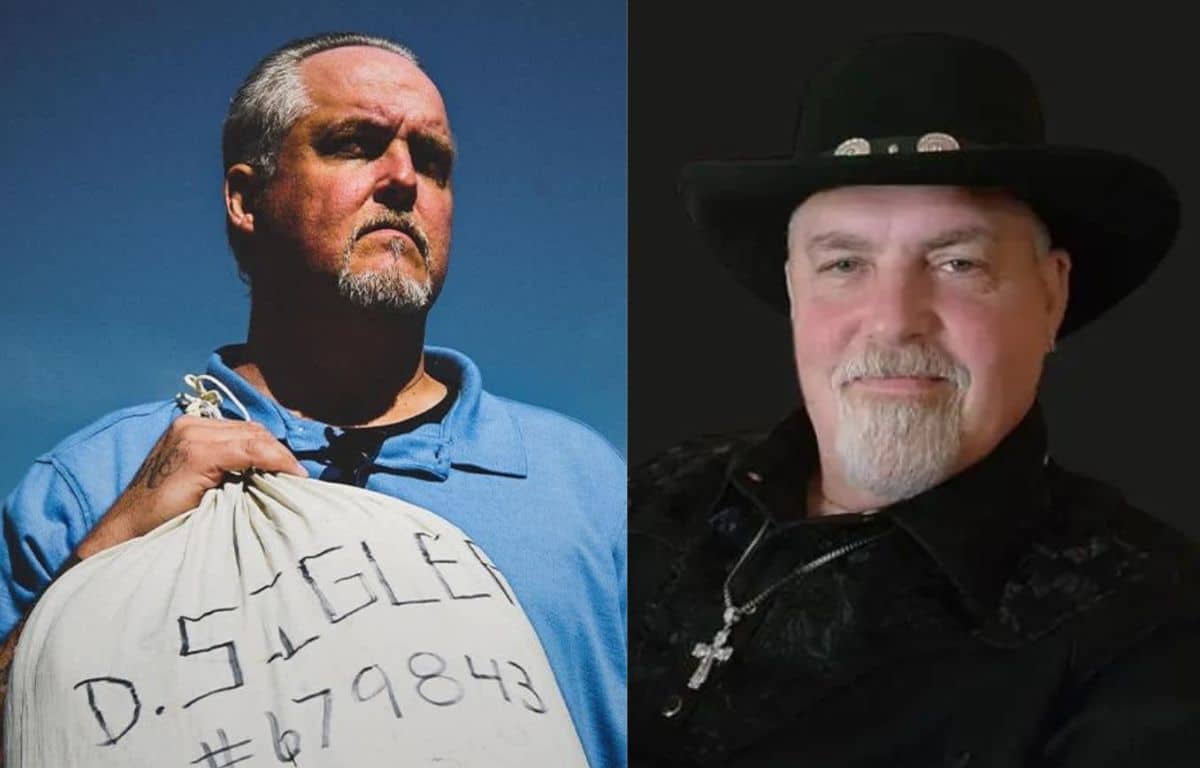

Dale Sigler's exact net worth is not publicly disclosed as such financial information is generally considered private. However, various sources estimate his net worth to be in the millions of dollars, primarily attributed to his successful business ventures, investments, and entertainment career.

Question 2: How did Dale Sigler accumulate his wealth?

Dale Sigler's wealth stems from a combination of factors, including his entrepreneurial endeavors, such as founding and leading several successful businesses. Additionally, his investments in real estate, stocks, and other financial instruments have contributed to his overall net worth.

Question 3: What are Dale Sigler's primary sources of income?

Dale Sigler's income is generated from multiple sources, including profits from his business ventures, dividends and capital gains from investments, and potential earnings from his entertainment activities. He has also been involved in brand endorsements and public appearances, which may contribute to his income streams.

Question 4: How does Dale Sigler manage his wealth?

Dale Sigler's wealth management strategies are not publicly known, as they involve personal and financial decisions. However, it is likely that he employs a team of financial advisors and wealth managers to assist him in managing his assets, investments, and overall financial planning.

Question 5: What is Dale Sigler's investment philosophy?

Dale Sigler's investment philosophy is not widely shared, as investment strategies are often tailored to individual circumstances and risk tolerance. However, it is possible that he follows a diversified investment approach, allocating his wealth across various asset classes such as stocks, bonds, real estate, and alternative investments, to manage risk and potentially enhance returns.

Question 6: What philanthropic or charitable efforts is Dale Sigler involved in?

Dale Sigler has been known to support various charitable causes and organizations. While the extent of his philanthropic activities is not fully known, his contributions have reportedly focused on education, healthcare, and community development initiatives.

Summary: Dale Sigler's net worth is a product of his entrepreneurial success, savvy investments, and income from various sources. He likely employs a team of financial advisors to manage his wealth and may follow a diversified investment approach. While the exact details of his financial situation are private, his involvement in charitable efforts highlights his commitment to giving back to the community.

Transition to the next article section: To delve deeper into Dale Sigler's business ventures, investments, and other aspects contributing to his net worth, please refer to the following sections of this article.

Tips for Building and Managing Net Worth

Understanding Dale Sigler's net worth and the strategies he may have employed can provide valuable insights for individuals seeking to build and manage their own net worth. Here are a few key tips to consider:

Tip 1: Diversify Your Income Streams

Reliance on a single source of income can be risky. Explore multiple income streams, such as starting a business, investing in dividend-paying stocks, or developing passive income sources, to reduce financial vulnerability and increase overall net worth.

Tip 2: Invest Wisely

Investing is crucial for long-term wealth growth. Consider a diversified investment portfolio that aligns with your risk tolerance and financial goals. Seek professional advice if needed to make informed investment decisions.

Tip 3: Manage Debt Effectively

High levels of debt can hinder net worth growth. Prioritize paying off high-interest debts and develop a strategy to reduce overall debt. Consider debt consolidation or refinancing options to potentially lower interest rates and save money.

Tip 4: Create a Budget and Stick to It

A well-defined budget is essential for managing expenses and tracking financial progress. Allocate funds wisely, prioritize savings, and avoid unnecessary spending to maximize net worth accumulation.

Tip 5: Seek Professional Advice

Financial advisors and wealth managers can provide valuable guidance in managing net worth effectively. They can help with investment planning, tax optimization, estate planning, and other complex financial matters.

Tip 6: Stay Informed and Adapt

Financial markets and economic conditions are constantly evolving. Stay informed about financial news and trends. Regularly review and adjust your financial strategies as needed to adapt to changing circumstances and maximize opportunities.

Summary: Building and managing net worth requires a combination of financial literacy, discipline, and strategic planning. By following these tips and learning from individuals like Dale Sigler, you can increase your financial resilience, achieve your financial goals, and secure your financial future.

Conclusion

Dale Sigler's net worth is a testament to his financial acumen and entrepreneurial success. His ability to generate multiple income streams, make strategic investments, and manage his wealth effectively has enabled him to accumulate substantial wealth over time.

Understanding the various aspects of Dale Sigler's net worth, including assets, liabilities, income, investments, and financial planning, provides valuable insights for individuals seeking to build and manage their own wealth. By following sound financial principles, diversifying income streams, investing wisely, and seeking professional advice when needed, individuals can increase their financial resilience and achieve their long-term financial goals.

Unveiling The Secrets: Michael Hutto's Wealth Revealed

Justin Warner's Net Worth: Uncover The Secrets Of His Real Estate Empire

Unveiling 6ix9ine's Fortune: Exploring Projections & Strategies For 2024

ncG1vNJzZmilkaPBtriWZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvDmqOeZaOetK2x0WalnqxdrLyzwMdnn62lnA%3D%3D