John Morgridge's net worth is the total value of his financial assets, including his income and investments. It is a measure of his financial health and success. For example, if John Morgridge has $10 million in assets and $5 million in liabilities, his net worth would be $5 million.

Knowing John Morgridge's net worth can be important for several reasons. It can give you an idea of his financial status and success. It can also help you understand his investment strategy and make informed decisions about your own investments.

Historically, John Morgridge's net worth has been impacted by a number of factors, including his success as a businessman and investor. He has also benefited from the growth of the stock market and the increase in value of his real estate holdings.

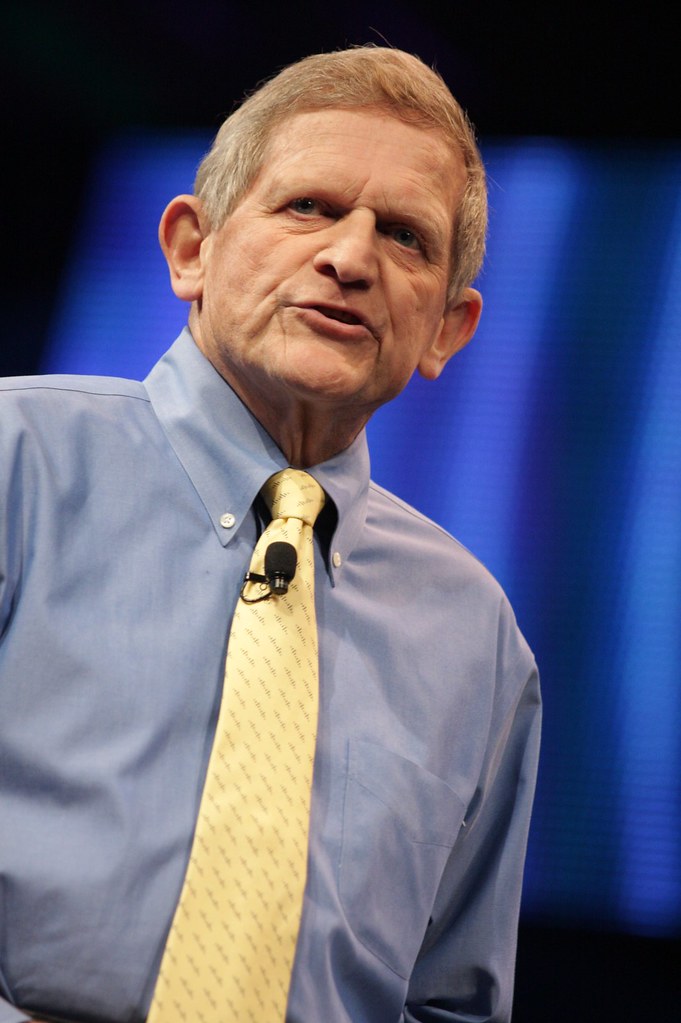

John Morgridge S Net Worth

Key aspects of John Morgridge's net worth include:

- Assets

- Liabilities

- Income

- Investments

- Business ventures

- Real estate holdings

- Stock market performance

- Economic conditions

- Tax laws

- Estate planning

These aspects are all interconnected and can have a significant impact on John Morgridge's net worth. For example, if the stock market performs well, the value of his investments will increase, which will in turn increase his net worth. Conversely, if the economy enters a recession, the value of his assets may decrease, which would reduce his net worth.

| Name | John Morgridge || --- | --- || Birth Date | May 17, 1930 || Birth Place | Chicago, Illinois, U.S. || Nationality | American || Occupation | Businessman, investor, philanthropist || Net Worth | $3.2 billion (USD) || Spouse | Tita Morgridge || Children | 3 || Education | Harvard Business School, Stanford University |Assets

Assets are a crucial component of John Morgridge's net worth. They represent the total value of his financial holdings and contribute significantly to his overall financial health. Assets can include a wide range of items, from cash and investments to real estate and business ventures.

- Cash and Cash Equivalents

Cash and cash equivalents are highly liquid assets that can be easily converted into cash. They include money in checking and savings accounts, money market accounts, and short-term certificates of deposit.

- Investments

Investments are assets that are expected to generate income or appreciate in value over time. They can include stocks, bonds, mutual funds, and real estate.

- Real Estate

Real estate is land and the buildings on it. It can be residential, commercial, or industrial. Real estate can be a valuable asset, especially in areas with strong economic growth.

- Business Ventures

Business ventures are companies or businesses that are owned and operated by an individual or group of individuals. Business ventures can be a significant source of income and wealth.

The value of John Morgridge's assets has fluctuated over time, depending on market conditions and the performance of his investments. However, his overall net worth has grown steadily over the years, thanks to his successful business ventures and prudent investment decisions.

Liabilities

Liabilities are debts or obligations that reduce the value of an individual's net worth. In the context of John Morgridge's net worth, liabilities represent the amount of money he owes to others. Common types of liabilities include loans, mortgages, and taxes.

- Loans

Loans are borrowed funds that must be repaid with interest. They can be used for a variety of purposes, such as purchasing a home, financing a business, or consolidating debt.

- Mortgages

Mortgages are loans secured by real estate. They are typically used to finance the purchase of a home.

- Taxes

Taxes are payments made to the government to fund public services. They can include income taxes, property taxes, and sales taxes.

- Other Liabilities

Other liabilities can include credit card debt, medical bills, and legal judgments. These liabilities can add up quickly and have a significant impact on an individual's net worth.

It is important for John Morgridge to carefully manage his liabilities to ensure that they do not outpace his assets. If his liabilities become too large, he may have difficulty repaying his debts and maintaining his financial health.

Income

Income plays a critical role in John Morgridge's net worth. Income is the money he earns from his various sources, such as his salary, investments, and business ventures. It is the primary means by which he increases his net worth.

Without a steady income, John Morgridge would not be able to maintain his current lifestyle or continue to grow his wealth. His income allows him to pay his living expenses, invest in new opportunities, and give back to his community.

One of the most significant sources of income for John Morgridge is his salary as the former CEO of Cisco Systems. He also receives income from his investments in stocks, bonds, and real estate. In addition, he has earned income from his various business ventures, such as his work with the venture capital firm Mohr Davidow Ventures.

Understanding the connection between income and John Morgridge's net worth is important for several reasons. First, it highlights the importance of earning a steady income to build and maintain wealth. Second, it shows how different sources of income can contribute to an individual's overall financial success. Third, it demonstrates the power of investing and compounding interest to grow wealth over time.

Investments

Investments play a critical role in John Morgridge's net worth. They are a key component of his overall financial strategy and have contributed significantly to his wealth. Investments allow him to grow his money over time and generate passive income.

There are many different types of investments that John Morgridge could make, including stocks, bonds, mutual funds, and real estate. He has a diversified portfolio that includes a mix of these asset classes. This diversification helps to reduce his risk and improve his overall returns.

One of the most significant investments that John Morgridge has made is in Cisco Systems. He was one of the co-founders of the company and served as its CEO for many years. Cisco Systems has been a very successful company, and its stock has performed well over the years. This investment has contributed significantly to John Morgridge's net worth.

In addition to his investment in Cisco Systems, John Morgridge has also made a number of other successful investments. He has invested in a variety of startups, many of which have gone on to become successful companies. He has also invested in real estate and other alternative investments.

Understanding the connection between investments and John Morgridge's net worth is important for several reasons. First, it highlights the importance of investing for long-term financial success. Second, it shows how different types of investments can contribute to an individual's overall wealth. Third, it demonstrates the power of compounding interest to grow wealth over time.

If you are interested in building your own wealth, it is important to understand the role that investments can play. By investing wisely, you can grow your money over time and achieve your financial goals.

Business ventures

Business ventures play a critical role in John Morgridge's net worth. He has been involved in a number of successful business ventures throughout his career, which have contributed significantly to his wealth. One of the most significant business ventures that John Morgridge has been involved in is Cisco Systems. He was one of the co-founders of the company and served as its CEO for many years. Cisco Systems has been a very successful company, and its stock has performed well over the years. This investment has contributed significantly to John Morgridge's net worth.

In addition to his involvement with Cisco Systems, John Morgridge has also been involved in a number of other successful business ventures. He has invested in a variety of startups, many of which have gone on to become successful companies. He has also invested in real estate and other alternative investments.

The connection between business ventures and John Morgridge's net worth is clear. His success in business has been a major factor in his overall financial success. By investing in successful businesses, he has been able to grow his wealth and achieve his financial goals.

The example of John Morgridge shows that business ventures can be a critical component of an individual's net worth. By investing in successful businesses, individuals can grow their wealth and achieve their financial goals. However, it is important to remember that business ventures also involve risk. There is no guarantee that a business venture will be successful. Therefore, it is important to carefully consider the risks involved before investing in any business venture.

Real estate holdings

Real estate holdings are a significant component of John Morgridge's net worth. They represent the total value of his real estate assets, including residential and commercial properties. Real estate holdings can provide a stable source of income through rent and appreciation in value.

- Residential properties

Residential properties are homes and other properties used for residential purposes. They can include single-family homes, multi-family homes, and apartments. Residential properties can generate income through rent and appreciation in value.

- Commercial properties

Commercial properties are properties used for business purposes. They can include office buildings, retail stores, and industrial warehouses. Commercial properties can generate income through rent and appreciation in value.

- Land

Land is undeveloped real estate that can be used for a variety of purposes, such as farming, development, or conservation. Land can appreciate in value over time and can be a valuable asset.

Real estate holdings can be a valuable asset for several reasons. First, real estate can provide a stable source of income through rent. Second, real estate can appreciate in value over time, which can lead to capital gains. Third, real estate can be used as collateral for loans. Overall, real estate holdings can be a significant contributor to an individual's net worth.

Stock market performance

Stock market performance plays a significant role in John Morgridge's net worth. The stock market is a collection of exchanges where stocks, or shares of ownership in companies, are bought and sold. The value of these stocks can fluctuate based on a variety of factors, including the company's financial performance, the overall economy, and investor sentiment.

- Stock prices

Stock prices are the prices at which stocks are bought and sold. When stock prices rise, the value of John Morgridge's investments will increase, and so will his net worth. Conversely, when stock prices fall, the value of his investments will decrease, and so will his net worth.

- Dividend income

Dividends are payments made by companies to their shareholders. John Morgridge receives dividend income from the stocks that he owns. Dividend income can be a significant source of income for investors, and it can contribute to the growth of John Morgridge's net worth.

- Capital gains

Capital gains are profits made from the sale of stocks. When John Morgridge sells a stock for more than he paid for it, he realizes a capital gain. Capital gains can be a significant source of income for investors, and they can contribute to the growth of John Morgridge's net worth.

Overall, stock market performance is a significant factor that can impact John Morgridge's net worth. By understanding the relationship between stock market performance and net worth, investors can make informed decisions about their investments.

Economic conditions

Economic conditions play a significant role in determining John Morgridge's net worth. Economic conditions can affect the value of his assets, his income, and his liabilities. For example, a strong economy can lead to an increase in the value of stocks and real estate, which can increase John Morgridge's net worth. Conversely, a weak economy can lead to a decrease in the value of these assets, which can decrease his net worth.

In addition to affecting the value of his assets, economic conditions can also affect John Morgridge's income. For example, a strong economy can lead to increased demand for his products and services, which can increase his income. Conversely, a weak economy can lead to decreased demand for his products and services, which can decrease his income.

Finally, economic conditions can also affect John Morgridge's liabilities. For example, a strong economy can lead to lower interest rates, which can reduce the cost of his debt. Conversely, a weak economy can lead to higher interest rates, which can increase the cost of his debt.

Overall, it is clear that economic conditions are a critical component of John Morgridge's net worth. By understanding the relationship between economic conditions and net worth, investors can make informed decisions about their investments.

Tax laws

Tax laws play a significant role in determining John Morgridge's net worth. Tax laws dictate the amount of taxes that John Morgridge must pay on his income, investments, and other assets. These taxes can have a significant impact on his overall financial situation.

For example, if tax laws change in a way that increases the amount of taxes that John Morgridge must pay, his net worth will decrease. Conversely, if tax laws change in a way that decreases the amount of taxes that he must pay, his net worth will increase.

In addition, tax laws can also affect the way that John Morgridge invests his money. For example, if tax laws change in a way that makes it more advantageous to invest in certain types of assets, John Morgridge may shift his investment portfolio accordingly. This could have a significant impact on the growth of his net worth.

Overall, it is clear that tax laws are a critical component of John Morgridge's net worth. By understanding the relationship between tax laws and net worth, investors can make informed decisions about their investments and financial planning.

Estate planning

Estate planning is the process of arranging for the distribution of one's assets after death. It is a critical component of financial planning, and it can have a significant impact on John Morgridge's net worth.

One of the most important aspects of estate planning is the creation of a will. A will specifies how a person's assets will be distributed after their death. It can also name an executor, who will be responsible for carrying out the terms of the will.

In addition to a will, other estate planning tools include trusts, life insurance, and charitable giving. These tools can be used to reduce taxes, protect assets, and ensure that a person's wishes are carried out after their death.

Estate planning is a complex and important process. It is important to seek the advice of an experienced estate planning attorney to ensure that your plan is properly executed.

This article has explored the various factors that contribute to John Morgridge's net worth. We have seen that his wealth is not simply a matter of luck, but the result of hard work, smart investment decisions, and a keen understanding of the financial markets. His success story is an inspiration to us all and shows us that anything is possible with dedication and perseverance.

There are several key points that we can take away from this article. First, it is important to invest early and often. The sooner you start investing, the more time your money has to grow. Second, it is important to diversify your investments. This will help to reduce your risk and improve your overall returns. Third, it is important to be patient. Investing is a long-term game, and it is important to be patient and let your money grow over time.

Uncovering The Secrets: A Comprehensive Guide To Forrie J Smith's Age And Life Journey

Dean Cain: A Heartwarming Reunion With His Parents And Son

Asa Akira's Net Worth: Unveiling The Fortune Of The Adult Film Star

ncG1vNJzZmikmayyr7PKnmWsa16qwG7DxKyrZmpelrqixs6nmLCrXpi8rnvJqJ%2BnZZ2kv6i%2ByJ2enmWjYrumwIywpqusmGO1tbnL