Definition: Alberto Guerra's net worth refers to the total value of his assets minus his liabilities. It is a measure of his financial worth.

Importance: Net worth is an important financial metric that can be used to track an individual's financial progress over time. It can also be used to compare one's financial position to others.

Benefits: Tracking net worth can help individuals make better financial decisions. For example, it can help them identify areas where they can save more money or invest more wisely.

Historical context: The concept of net worth has been around for centuries. However, it has become increasingly important in recent years as more and more people have begun to track their finances online.

Main article topics:

- How to calculate net worth

- The importance of net worth

- How to increase net worth

alberto guerra net worth

Alberto Guerra's net worth is a measure of his financial wealth. It is calculated by subtracting his liabilities from his assets. Guerra's net worth is important because it provides a snapshot of his financial health and can be used to track his financial progress over time.

- Assets: Guerra's assets include his cash, investments, and property.

- Liabilities: Guerra's liabilities include his debts, such as his mortgage and credit card balances.

- Net worth: Guerra's net worth is his assets minus his liabilities.

- Income: Guerra's income is the money he earns from his job or other sources.

- Expenses: Guerra's expenses are the money he spends on living expenses, such as food, housing, and transportation.

- Savings: Guerra's savings are the money he has left over after he pays his expenses.

- Investments: Guerra's investments are the assets he owns that are expected to grow in value over time.

- Financial goals: Guerra's financial goals are the specific financial objectives he wants to achieve, such as buying a house or retiring early.

By understanding these key aspects of net worth, Guerra can make better financial decisions and achieve his financial goals.

Assets

Assets are an important part of Alberto Guerra's net worth. They represent the value of everything that he owns, and they can be used to generate income or to secure loans. Guerra's assets include his cash, investments, and property.

- Cash: Guerra's cash includes the money he has in his checking and savings accounts, as well as any other liquid assets, such as money market accounts and certificates of deposit.

- Investments: Guerra's investments include stocks, bonds, mutual funds, and other financial instruments. These investments can provide Guerra with income in the form of dividends or interest, and they can also grow in value over time.

- Property: Guerra's property includes his home, any rental properties he owns, and any other land or buildings that he owns.

The value of Guerra's assets can fluctuate over time. For example, the value of his investments may go up or down depending on the performance of the stock market. However, over the long term, Guerra's assets are likely to grow in value, which will increase his net worth.

Liabilities

Liabilities are an important part of Alberto Guerra's net worth because they represent the amount of money that he owes to others. Guerra's liabilities include his debts, such as his mortgage and credit card balances. These debts can have a significant impact on his net worth, as they reduce the amount of money that he has available to invest or save.

For example, if Guerra has a mortgage balance of $200,000, this means that he owes $200,000 to his lender. This debt will reduce his net worth by $200,000. Similarly, if Guerra has a credit card balance of $10,000, this means that he owes $10,000 to his credit card company. This debt will also reduce his net worth by $10,000.

It is important for Guerra to manage his liabilities carefully in order to maintain a healthy net worth. He should make sure to only take on debt that he can afford to repay, and he should always make his payments on time. By managing his liabilities effectively, Guerra can improve his net worth and achieve his financial goals.

Net worth

Net worth is a crucial component of "alberto guerra net worth" because it provides a snapshot of his financial health at a specific point in time. It is calculated by subtracting his liabilities from his assets. Assets include cash, investments, and property owned by Guerra, while liabilities are debts owed by him, such as mortgages, loans, and credit card balances. By understanding the relationship between assets and liabilities, Guerra can make informed financial decisions that can impact his net worth.

For instance, if Guerra decides to purchase an investment property, this would be considered an asset as it has the potential to generate rental income and appreciate in value. On the other hand, if he takes out a loan to finance this purchase, the loan amount would be considered a liability that reduces his net worth. Therefore, it is essential for Guerra to carefully consider the impact of his financial decisions on his overall net worth.

In summary, understanding the concept of net worth and its components is vital for Guerra to effectively manage his finances, make sound investment decisions, and achieve his long-term financial goals.

Income

Income is a crucial component of Alberto Guerra's net worth as it directly impacts his ability to accumulate assets and reduce liabilities. Without a steady income stream, Guerra would face challenges in meeting his financial obligations and building wealth. Income serves as the primary means for Guerra to increase his net worth over time.

For instance, if Guerra earns a monthly salary of $10,000 and consistently saves 20% of it, he would accumulate savings of $24,000 in a year. This accumulated savings can be invested in assets, such as stocks or real estate, which have the potential to generate passive income and appreciate in value. Over the long term, these investments can contribute significantly to Guerra's net worth.

Conversely, if Guerra's income decreases or becomes unstable, it can negatively impact his net worth. Reduced income can make it difficult for him to meet his expenses, repay debts, and save for the future. This can lead to a decline in his net worth and hinder his ability to achieve his financial goals.

Therefore, maintaining a steady income and exploring opportunities to increase earnings are essential for Guerra to grow his net worth and secure his financial future.

Expenses

Expenses play a critical role in determining Alberto Guerra's net worth. Every peso he spends reduces his net worth, while every peso he saves increases it. Therefore, managing expenses effectively is essential for building wealth.

For instance, if Guerra spends $500 per month on dining out, he could save $6,000 per year by preparing more meals at home. This saved amount could be invested in a diversified portfolio of stocks, bonds, or real estate, which has the potential to generate passive income and grow in value over the long term.

Conversely, if Guerra's expenses exceed his income, he will have to borrow money to cover the shortfall. This will increase his liabilities and reduce his net worth. High levels of debt can also make it difficult to qualify for loans in the future and can lead to financial distress.

Therefore, Guerra must carefully monitor his expenses and identify areas where he can save money without sacrificing his quality of life. By living below his means and making smart financial decisions, he can increase his savings, reduce his debts, and grow his net worth over time.

Savings

Savings play a crucial role in Alberto Guerra's net worth. Savings represent the portion of his income that he does not spend on current expenses, and they are essential for building wealth over time.

- Facet 1: Savings as a Buffer against Financial Emergencies

Savings provide a financial cushion to cover unexpected expenses, such as medical bills, car repairs, or job loss. By having a healthy savings balance, Guerra can avoid going into debt or selling assets to meet these emergencies, which can negatively impact his net worth. - Facet 2: Savings as a Source of Investment Capital

Savings can be invested to generate passive income and grow Guerra's net worth over time. For example, he could invest in stocks, bonds, or real estate. These investments have the potential to provide returns that outpace inflation, allowing Guerra to increase his wealth even while he is not actively working. - Facet 3: Savings as a Means to Achieve Financial Goals

Savings are essential for achieving long-term financial goals, such as buying a house, retiring early, or funding a child's education. By setting aside a portion of his income each month, Guerra can accumulate the necessary funds to reach these goals without having to rely on debt or external financing.

In conclusion, savings are a vital component of Alberto Guerra's net worth. By saving consistently and investing wisely, he can build wealth, achieve his financial goals, and secure his financial future.

Investments

Investments play a pivotal role in Alberto Guerra's net worth as they represent assets with the potential to appreciate in value over time. By investing in assets such as stocks, bonds, real estate, or mutual funds, Guerra can diversify his portfolio and increase his overall net worth.

For instance, if Guerra invests $10,000 in a stock index fund that grows at an average rate of 7% per year, his investment would be worth approximately $17,000 in 10 years. This growth in value directly contributes to Guerra's net worth, increasing it by $7,000.

Investing wisely requires careful research and a long-term perspective. Guerra must assess the risks and potential returns of each investment opportunity before committing his funds. By making informed investment decisions and managing his portfolio effectively, Guerra can harness the power of compound interest to grow his net worth significantly over time.

Financial goals

Financial goals are essential components of Alberto Guerra's net worth because they provide direction and purpose to his financial decisions. By setting clear financial goals, Guerra can align his financial actions with his long-term aspirations, which can ultimately increase his net worth.

For instance, if Guerra wants to buy a house in five years, he needs to determine how much money he needs to save for a down payment and closing costs. He can then create a savings plan that outlines how much he needs to save each month to reach his goal. By having a specific financial goal in mind, Guerra is more likely to stay motivated and make sacrifices in the present to achieve his future aspirations.

Furthermore, financial goals can help Guerra prioritize his investments and make informed decisions about how to allocate his resources. For example, if Guerra's goal is to retire early, he may choose to invest in a combination of stocks and bonds that offer a balance of growth potential and stability. By aligning his investment strategy with his financial goals, Guerra can increase the likelihood of achieving his desired outcomes.

In summary, financial goals are crucial for Alberto Guerra's net worth because they provide direction, motivation, and a framework for making informed financial decisions. By setting clear financial goals and aligning his actions with those goals, Guerra can increase his chances of achieving financial success and building a substantial net worth.

FAQs about "alberto guerra net worth"

This section answers some of the most frequently asked questions about Alberto Guerra's net worth, providing concise and informative responses.

Question 1: How much is Alberto Guerra's net worth?

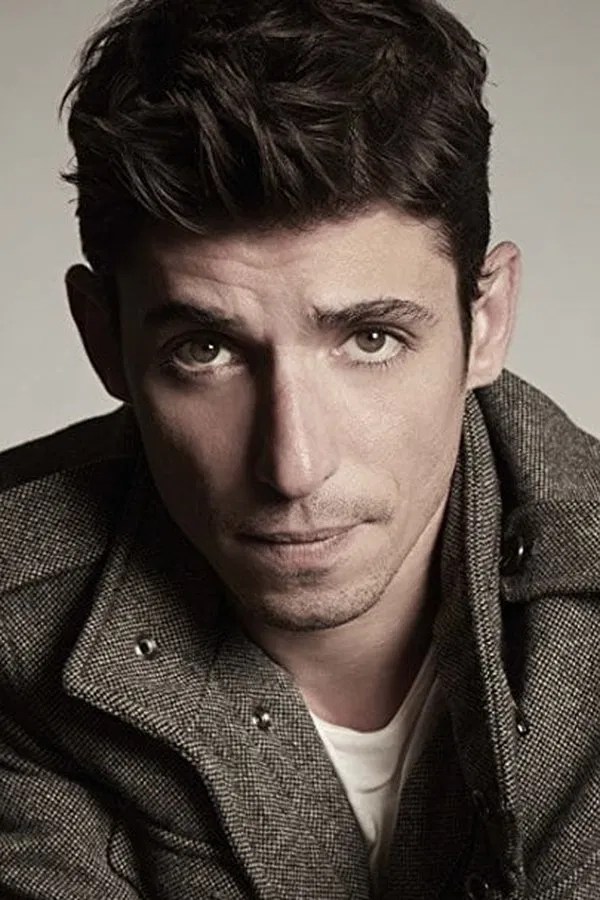

Alberto Guerra's net worth is estimated to be around $10 million. This figure is based on his earnings from acting, endorsements, and other business ventures.

Question 2: How did Alberto Guerra accumulate his wealth?

Guerra's wealth primarily comes from his successful acting career. He has starred in numerous popular films and television shows, including "The 100" and "Narcos: Mexico." Guerra has also earned income through endorsements and business ventures, such as his own clothing line.

Question 3: What is Alberto Guerra's investment strategy?

Guerra's investment strategy is not publicly known. However, given his wealth, it is likely that he has a diversified portfolio that includes stocks, bonds, and real estate.

Question 4: What are Alberto Guerra's financial goals?

Guerra's financial goals are not publicly known. However, it is likely that he is focused on preserving and growing his wealth for the long term.

Question 5: What can we learn from Alberto Guerra's financial success?

Guerra's financial success demonstrates the importance of hard work, dedication, and smart financial management. It is also a reminder that anyone can achieve financial success with the right mindset and strategies.

Summary: Alberto Guerra's net worth is a testament to his hard work and financial savvy. By understanding the key factors that have contributed to his wealth, we can learn valuable lessons about financial management and investment.

Transition to the next article section: In the next section, we will explore the specific financial strategies and habits that have helped Alberto Guerra achieve financial success.

Tips to Increase Net Worth

Individuals seeking to increase their net worth can learn valuable lessons from Alberto Guerra's financial strategies. Here are some practical tips based on his approach to wealth accumulation:

Tip 1: Set Clear Financial Goals

Establishing specific financial goals provides direction and motivation for your financial decisions. Identify your short-term and long-term financial aspirations, such as purchasing a home, funding your children's education, or retiring comfortably.

Tip 2: Create a Budget and Track Expenses

A budget helps you monitor your income and expenses effectively. Track your spending patterns to identify areas where you can save money and redirect funds towards your financial goals.

Tip 3: Invest Wisely

Invest a portion of your income in a diversified portfolio of assets, such as stocks, bonds, and real estate. Research different investment options and consult with a financial advisor to determine the right mix for your risk tolerance and financial goals.

Tip 4: Increase Your Income

Explore opportunities to increase your income through career advancement, starting a side hustle, or investing in income-generating assets. Additional income can be used to save, invest, or pay down debt.

Tip 5: Reduce Debt

High levels of debt can hinder your ability to accumulate wealth. Prioritize paying off high-interest debts, such as credit card balances, and consider consolidating or refinancing debt to lower interest rates.

Tip 6: Seek Professional Advice

Consult with a financial advisor or tax professional for personalized guidance on wealth management, investment strategies, and tax optimization. Professional advice can help you make informed decisions and maximize your financial potential.

Summary: By implementing these tips and adopting a disciplined approach to financial management, individuals can increase their net worth and achieve their financial goals. Remember, building wealth requires patience, consistency, and a commitment to sound financial habits.

Transition to the article's conclusion: In conclusion, understanding the principles behind Alberto Guerra's net worth provides valuable insights into the strategies and habits that can help anyone achieve financial success.

Conclusion

In exploring "alberto guerra net worth," this article has highlighted the key factors that have contributed to his financial success. From setting clear financial goals and managing expenses to investing wisely and seeking professional advice, Guerra's approach to wealth accumulation provides valuable lessons for anyone seeking to increase their net worth.

Remember, building wealth is a journey that requires a disciplined approach, patience, and a commitment to sound financial habits. By adopting the principles outlined in this article, individuals can empower themselves to achieve their financial goals and secure their financial futures.

Unveiling Melissa Gorga's Maiden Name: Uncover Her Heritage And Lineage

Haley Joel Osment's Romantic Journey: Unveiling Love, Privacy, And Speculation

Jenna Coleman's Relationships: Unraveling The Mysteries Behind The Star's Love Life

ncG1vNJzZmiskay7unrApqpsZpSetKrAwKWmnJ2Ro8CxrcKeqmebn6J8orjBnqmtp12cwqa%2B0Zpkp52kYsSwvtOhZaGsnaE%3D